Taking input tax credit in respect of inputs and capital goods sent for job work. It is an Indirect tax which introduced to replacing a host of other Indirect taxes such as value added tax service tax purchase tax excise duty and so onGST levied on the.

New Gst Rule 86a Input Tax Credit Can Be Blocked Under Gst Baba Tax

NEFTRTGS payment of Central Excise Service Tax Duties will not be available from 2200 Hours on 24th June 2022 to 0730 Hours on 25th June 2022 and again from 2200 Hours on 25th June 2022 to 0730 Hours on 26th June 2022 Procedure relating to sanction post-audit and review of refund claims Notification issued to to waive off late fee under section 47 for the period from.

. Apportionment of credit and blocked credits. GST Act and Rules updated as on date. The tax was introduced as a replacement of all other forms of indirect tax like sales tax VAT etc.

Input Tax- Section 262 of CGST Act 2017. Once the registration process has been completed the Goods and Service Tax Identification Number GSTIN is provided. What is GST how it works.

GST stands for Goods and Services Tax. The process by which a taxpayer gets registered under Goods and Service Tax GST is GST registration. This Page is BLOCKED as it is using.

Ineligible Input Tax Credit ITC Under GST. Article explains about Input tax Credit ITC unbder GST Taxes under GST to claim ITC Conditions to claim ITC Eligible persons to claim ITC Manner to claim. Q - What happens when the GST Form RFD-01 has some errors.

The cascading of taxes. Ineligible Input Tax Credit ITC Under GST. Input tax credit can be availed when any goods or services are being purchased.

Section wise and Chapter wise. Manner of distribution of credit by Input Service Distributor. Input tax credit can thus rightly be called as the lifeline of any GSTVAT regime.

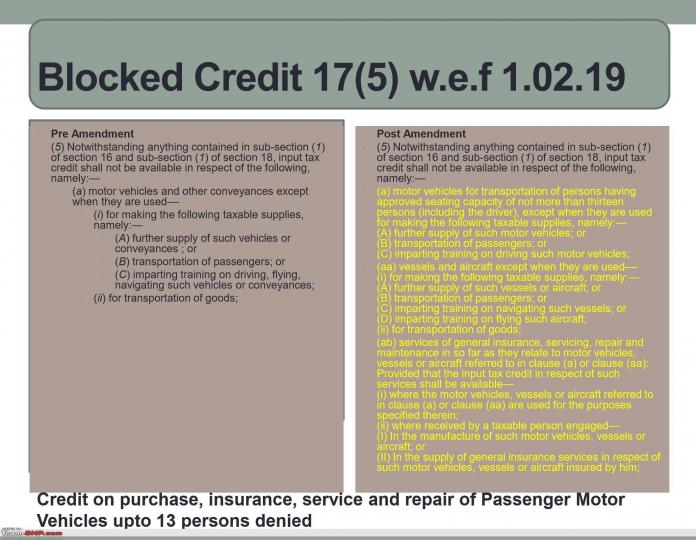

ITC Definition under GST Law. In case of discrepancies. However there are some goods and services on which ITC cannot be availed and is blocked which we discuss in this article.

Table 6B needs a declaration of inward supplies on which ITC is claimed successfully and was. Your input tax credits can also be blocked in future. By Kanika Sharma 193K Views November 30 2018 Introduction.

Officials told ET that the new GSTR-3B approved by the Council would include auto-population of outward supplies from. Goods and Service Tax GST is an indirect tax which is applicable on the supply of goods and services. The items on which ITC cannot be availed must be recorded in the.

The Goods and Services Tax GST Council has approved comprehensive procedural changes including a new draft form to ease compliances and also curb input tax credit frauds. The credits which are not eligible under the law like the blocked credits etc. The GST regime in India too allows seamless credit on all inputs input services and capital goods used for the purposes of business of a taxable person except blocked credit where input tax credit is not available even.

The above are simple meaning of ITC Input Tax Credit now let us see what the law says. The latest form will soon be put up for stakeholder consultations. Input- Section 259 of CGST Act 2017 Input means any goods other than capital goods used or intended to be used by a supplier in the course or furtherance of business.

Gst Blocked Input Tax Gabrieltrf

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017

Gst Authority Needs To Communicate Reasons For Blocking Itc Of The Taxpayer A2z Taxcorp Llp

No More Input Tax Credit On Automotive Invoices Team Bhp

Uppsc Blocked Credit Of Input Tax In Gst Offered By Unacademy

Gst Gujarat High Court Issues Notices To Central State Over Blocking Of Itc Under Rule 86a

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017

Input Tax Credit Under Gst Goods And Service Tax Simple Tax India

Apportionment Of Credit And Blocked Credit Under Gst

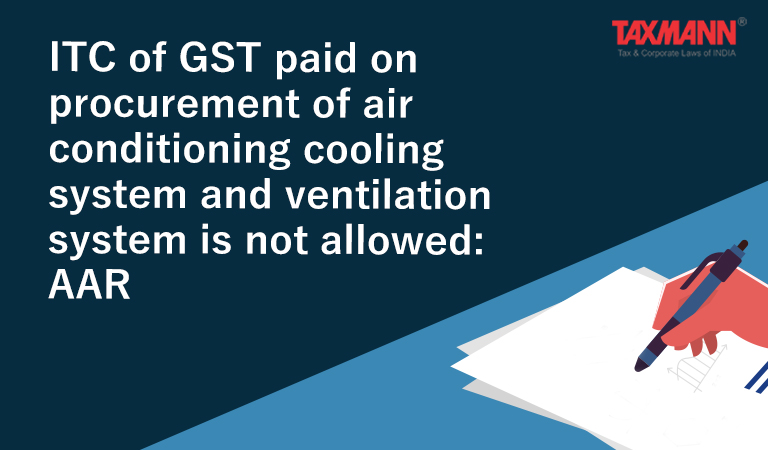

Itc Of Gst Paid On Procurement Of Air Conditioning Cooling System And Ventilation System Is Not Allowed Aar

An Overview Of Blocked Itc Under Gst Corpbiz Advisors

Input Tax Credit On Motor Vehicle Under Gst

Apportionment Of Input Tax Credit Itc Under Gst Section 17 1 2 3 Of Cgst Act 2017

Blocking Of Itc When Credit Not Available In Ledger Is Without Jurisdiction And Illegal Hc

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

What Is Blocked Credit As Per Section 17 5 Input Tax Credit In Gst

Input Tax Credit Under Gst Taxmann Blog

Itc Not Available On Gst Paid For Transfer Of Rights Of Industrial Plot For Construction Of Immovable Property Aar

Gst Input Tax Credit Definitions And Conditions For Claiming Gst Itc